End of Life Decisions

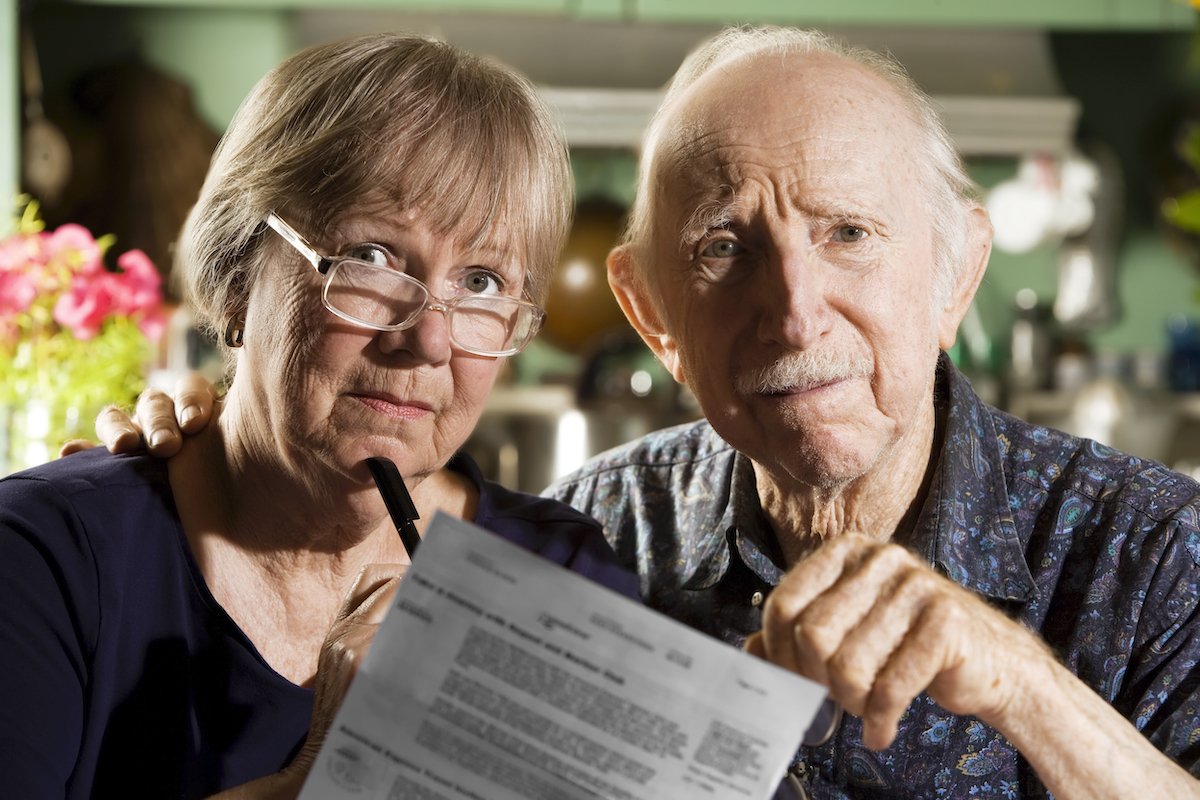

As we get older, we need to have in place some important legal documents to protect ourselves, our family and our assets. If you wait too long, it could be too late.

On March 31, 2005, American woman Terry Schiavo passed away, after a 15 year legal battle over her fate. During this time, her case became an international lightning rod for the discussion over end-of-life issues.

In brief, Terry had collapsed in her home on February 25, 1990. When the ambulance arrived, she was not breathing and had no pulse.

Details