Importance of Pet Trusts

To find this video on our Youtube Channel, please click the link below:

Importance of Pet Trusts

DetailsOldest Law Firm in South Australia - Founded 1848 | (08) 8212 7233

To find this video on our Youtube Channel, please click the link below:

Importance of Pet Trusts

Details

“Love is lovelier, the second time around…” So says the beautiful old song. But the joy of finding love again and creating another family can quickly fade when the realities & pressures of the varying relationships are revealed. Multiple relationships equals multiple potential points of failure. Blended families can face complex estate-planning challenges, and issues can arise between spouses or between children and their spouses.

Over 70 percent of remarriages where children are involved result in divorce after less than six years. Add death and grief to the equation, and you can understand why challenges to deceased estates occur.

DetailsModern medicine is helping us live longer life spans than ever before, but a good portion of the ageing population needs assistance from family members or other caregivers as time goes on. This dependency, coupled with the older person’s declining physical or mental state, unfortunately creates favourable conditions for a caregiver to manipulate the estate planning process for his or her own benefit. This is called undue influence, and when you consult with Genders & Partners for Wills & estate planning in Adelaide, we will do everything in our power to protect you from those who do not have your best interests at heart.

DetailsIt’s a great feeling to finally complete your estate plan and know that you, your family and your assets are protected. After completing this important and necessary task with the help of your Wills & estate planning lawyer in Adelaide, you can get on with enjoying your life rather than contemplating your mortality. However, there’s one more step you need to take to ensure that your beneficiaries receive what is rightfully theirs without any hassle: You must properly store the original Will and inform the right people of its location. This simple task ensures that when the time comes, your executors can get to work doing their job of carrying out your wishes as quickly and efficiently as possible.

DetailsTo find this video on our Youtube Channel, please click the link below:

Estate Planning Challenges Experienced By Blended Families

Details

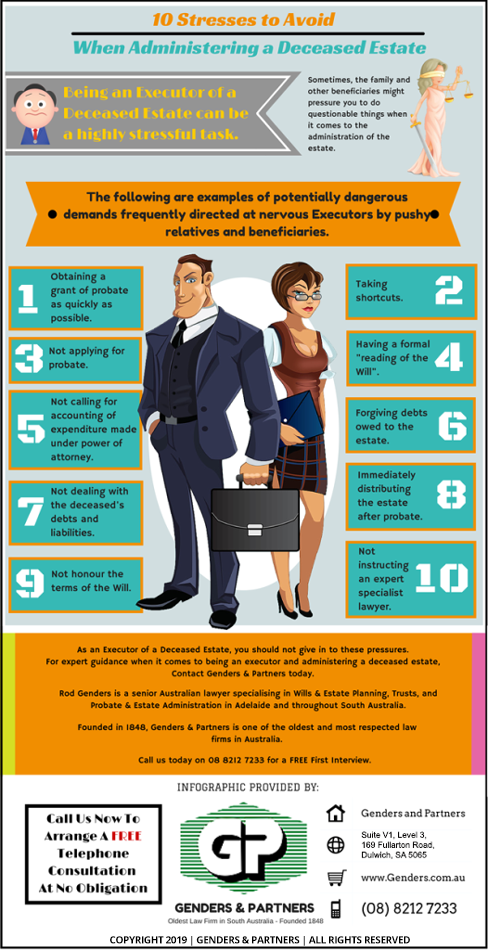

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road Dulwich, South Australia 5065

In a 2014 Judgment, the Supreme Court of Queensland ruled that the administrator of a deceased estate breached her fiduciary duty by applying for her deceased son’s superannuation benefits to be paid to her personally, rather than on behalf of his estate.

This is an example of where a little knowledge can be a dangerous thing. Probate and Deceased Estate administration is a specialised area of law. Don’t be fooled into believing the lady at the hairdresser or the bloke down the pub who says that it is easy to do this yourself, or that the lawyer who handled your divorce, or your uncle’s drink-driving offence, can easily do this. If you pay peanuts, you’re very likely to get monkeys.

DetailsContact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road, Dulwich, SA 5065

Details