Intestacy: The Hidden Risks and Costs of Dying Without a Valid Will

Perhaps you intend to create a Will but just haven’t gotten around to it, or maybe the size of your estate is such that you don’t think you need one. “Dying intestate” is the legal term for dying without a Will or leaving a Will that does not adequately deal with all of your property.

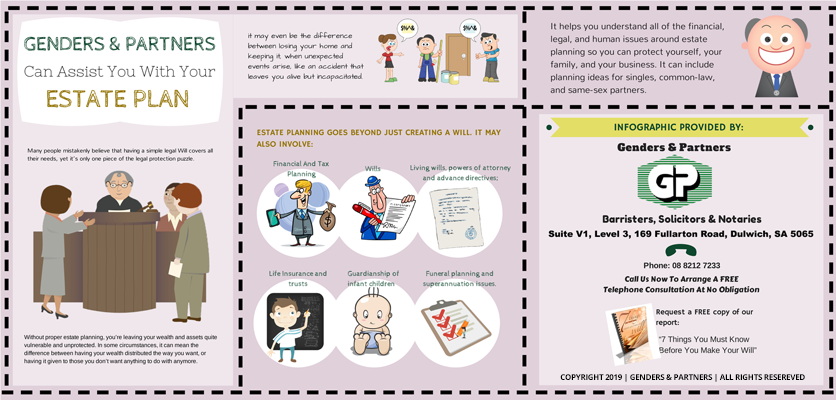

Intestacy is all but a guarantee that your loved ones will suffer a needlessly complex and expensive legal process after your death. Your best protection is to make your wishes known by consulting with a specialist Adelaide Wills lawyer at Genders & Partners.

Family Disputes and Costly Legal Battles

A Will dictates how your assets are distributed and names executors to lawfully carry out your wishes. Without a Will in place, you have no say in who inherits what. There are intestacy laws in every state and territory of Australia that determine the distribution of assets among your nearest blood relatives, but your loved ones may dispute the process and cause drawn-out legal battles, the costs of which are deducted from the estate. These state laws vary from time to time and from place to place, so the precise formula which decides who will inherit your assets depends on when and where you die.

A Pet Trust To Look After Your Pet When You Cannot

If you become incapacitated or die, what will happen to your pets?

Most pets are dependent on humans for food and shelter, and are unable to look after themselves. It is cruel and illegal to release your pet into the wild to fend for itself, and there may be environmental concerns even if it could survive. As a loving and responsible pet-owner you should include the future well-being of your surviving pets in your plan.

Genders & Partners is the oldest law firm in South Australia, and we have the knowledge, experience and sensitivity to ensure that the right provisions are made for the ongoing care of your pets if you should outlive them or lose the ability to care for them.

If you die or get carried off to hospital suddenly, your pet might be enclosed in a yard, a cage or inside the house. Your family has enough to deal with getting to grips with your illness or death, let alone worrying about a house full of pets. Will they even remember that you have a pet? Probably not for several days, if at all. We suggest setting up a South Australian Pet Trust, as this is a legal document which covers the ongoing care of domestic animals in specific circumstances, such as in the event of your death or incapacity. It names new caregivers or requests that trustees search for new homes for your pets. A trustee is then legally authorised to carry out your wishes from the day of your death or incapacity. A Pet Trust in South Australia differs from a Will, which may take weeks or months to come into effect, as it may require a Court process known as Probate.

Granny Napping Set to Rise as Baby Boomers Age

Granny napping is defined as the legal movement of an elderly person from one residential location to another, and could include the removal of an elderly person from a nursing home care facility.

The aim of this may be to remove the elderly person from contact with other people such as family & friends, in order to isolate them and to facilitate financial abuse. The prevalence of granny napping is expected to rise as affluent baby boomers age.

There has been a steady increase of “Elder Abuse”, and a decline in the treatment of vulnerable people in our society. This leaves the assets of the elderly person open to abuse. There have been instances where elderly people have been left to starve as disagreeable, uncaring relatives demand food and money from their elderly relatives.

Houses of elderly relatives have even been sold and the relative has been forced to move out. This is just the tip of the iceberg when it comes to granny napping and elderly abuse not just here in South Australia, but throughout the rest of Australia, too.

One of the inherent problems in Australian society is the lack of effective communication between siblings and between siblings and elderly parents. Bitter relationships have sometimes developed between these individuals. Elderly people who have not yet succumbed to dementia or other debilitating diseases have even gone so far as making out Wills that only name grandchildren as beneficiaries, in an attempt to bypass their problematic & meddling children. However this only tends to add even more fuel to the fire when it comes to resolving inheritance issues and often leads to litigation, which in some cases have involved grandchildren having to give back money to their own parents.

Elder Abuse Caused by Lack of Estate Planning

On 26/02/2014 the UK Court of Protection decided the case of JS –v- KB & MP .

The Court itself said: “This cautionary tale illustrates vividly the dangers of informal family arrangements for an elderly relative who lacks mental capacity, made without proper regard for:

i. the financial and emotional vulnerability of the person who lacks capacity; and

ii. the requirements for formal, and legal, authorisation for the family’s actions, specifically in relation to property and financial affairs.”

The case concerned a 90 year-old female suffering from a progressive dementia. She had been cared for by her daughter for over three years. The Court found that “The actual care arrangement is in many ways excellent … [the patient] is receiving devoted care and is reported to be happy. For this, [the daughter] deserve genuine credit.”