The Importance of Updating Your Will And Estate Plan

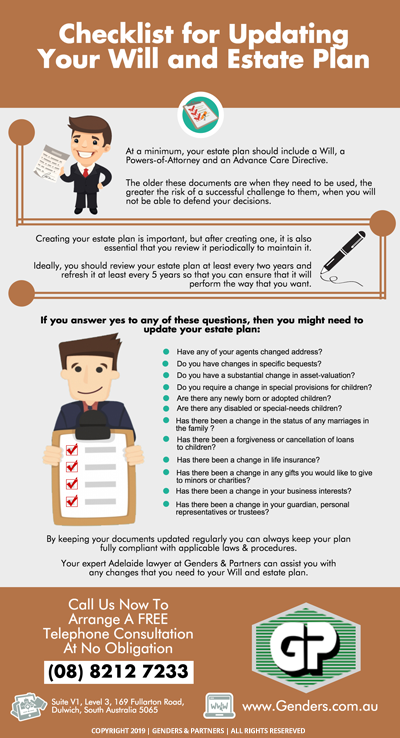

At a minimum, your estate plan includes a Will and some powers-of-attorney. These documents are NOT set & forget. They are snapshots of your intentions at that point in time.

The older these documents are when they need to be used, the greater the risk of a successful challenge to them, when you will not be able to defend your decisions. It’s all about Risk Management.

If you have a proven track record of reviewing and confirming or amending your estate planning documents and keeping them up to date every 3-5 years, there is a much reduced risk of interference with your wishes.