The Rise of Challenges to Deceased Estates from Blended Families

“Love is lovelier, the second time around…” So says the beautiful old song. But the joy of finding love again and creating another family can quickly fade when the realities & pressures of the varying relationships are revealed. Multiple relationships equals multiple potential points of failure. Blended families can face complex estate-planning challenges, and issues can arise between spouses or between children and their spouses.

Over 70 percent of remarriages where children are involved result in divorce after less than six years. Add death and grief to the equation, and you can understand why challenges to deceased estates occur.

Estate Planning Challenges Experienced By Blended Families

To find this video on our Youtube Channel, please click the link below:

Estate Planning Challenges Experienced By Blended Families

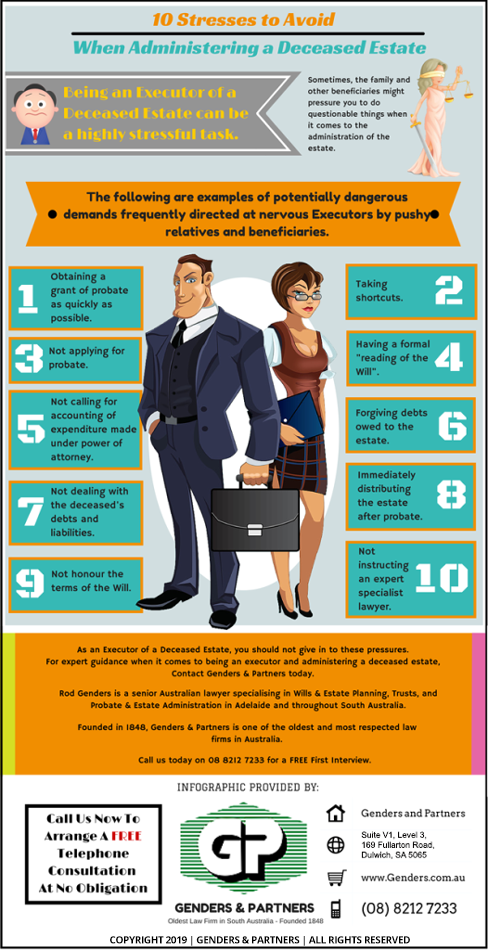

10 Stresses to Avoid When Administering a Deceased Estate

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road Dulwich, South Australia 5065

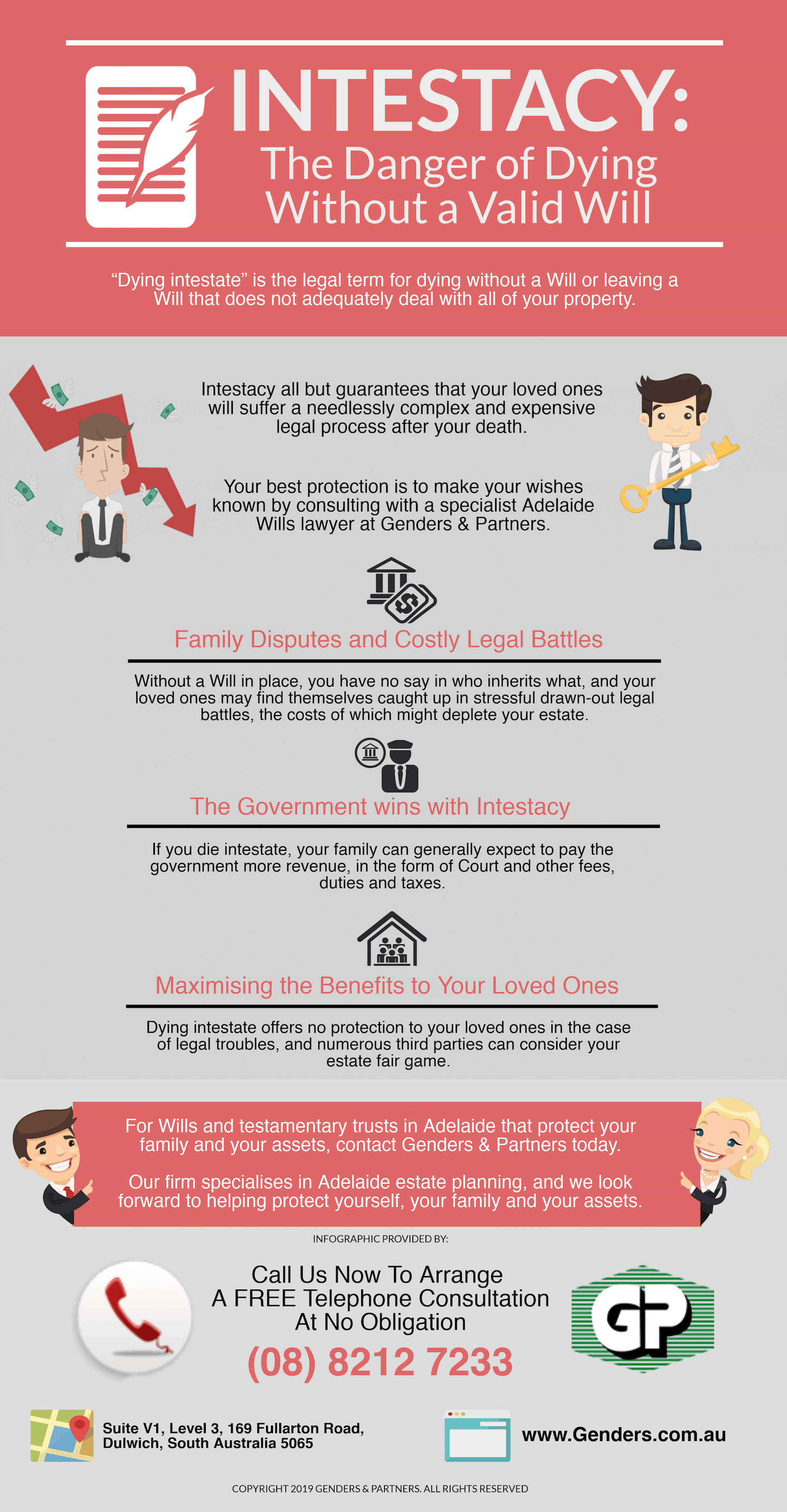

Intestacy: The Hidden Risks and Costs of Dying Without a Valid Will

Perhaps you intend to create a Will but just haven’t gotten around to it, or maybe the size of your estate is such that you don’t think you need one. “Dying intestate” is the legal term for dying without a Will or leaving a Will that does not adequately deal with all of your property.

Intestacy is all but a guarantee that your loved ones will suffer a needlessly complex and expensive legal process after your death. Your best protection is to make your wishes known by consulting with a specialist Adelaide Wills lawyer at Genders & Partners.

Family Disputes and Costly Legal Battles

A Will dictates how your assets are distributed and names executors to lawfully carry out your wishes. Without a Will in place, you have no say in who inherits what. There are intestacy laws in every state and territory of Australia that determine the distribution of assets among your nearest blood relatives, but your loved ones may dispute the process and cause drawn-out legal battles, the costs of which are deducted from the estate. These state laws vary from time to time and from place to place, so the precise formula which decides who will inherit your assets depends on when and where you die.

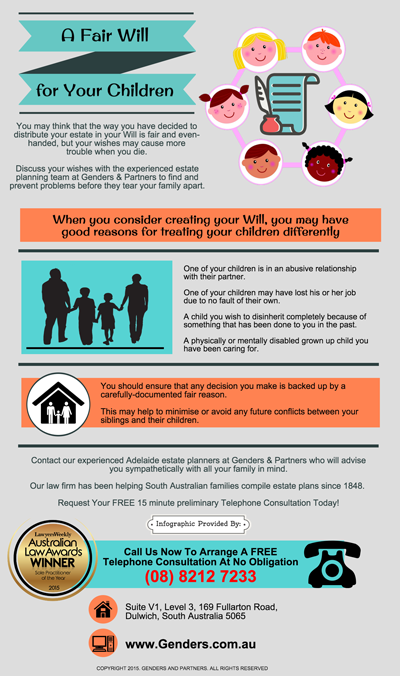

Treating Your Kids Differently in Your Will

Family relationships can turn into nasty confrontations when it comes to administering a deceased estate and distributing assets. You may think that the way you have decided to distribute your estate in your Will is fair and even-handed, but your wishes may cause more trouble than they are worth when you die.

You should discuss your wishes with the experienced specialist estate planning team in Adelaide at Genders & Partners solicitors, so that you can find and prevent problems before they tear your family apart.

When you consider creating your Adelaide Will you may have good reasons for treating your children differently. If one of your children is in an abusive relationship with their partner, for instance, you probably will not want the abusive partner to get their hands on any of your assets. This can prove to be a difficult situation, and requires special care and attention. Special provision may have to be made to ensure that your assets are protected.

There are situations when one of your children may have lost his or her job due to no fault of their own and you may wish to allocate more of your assets to this person, knowing that it might be difficult for him or her to find employment. These sorts of decisions may seem right to you but they may seem unfair to another hardworking child who feels he or she has missed out on an equal entitlement to your estate.