GST likely to rise – I told you so

On 20th July 2015 South Australian premier Jay Weatherill provided conditional support for the call from New South Wales Premier Mike Baird for GST to be increased to 15 per cent.

The increasing cost of healthcare in the context of an ageing population, is a precipitating factor in this debate. The substantially reduced tax collections from mining revenues and the overall depressed economy, especially in South Australia, are critical elements.

The Rise of Challenges to Deceased Estates from Blended Families

“Love is lovelier, the second time around…” So says the beautiful old song. But the joy of finding love again and creating another family can quickly fade when the realities & pressures of the varying relationships are revealed. Multiple relationships equals multiple potential points of failure. Blended families can face complex estate-planning challenges, and issues can arise between spouses or between children and their spouses.

Over 70 percent of remarriages where children are involved result in divorce after less than six years. Add death and grief to the equation, and you can understand why challenges to deceased estates occur.

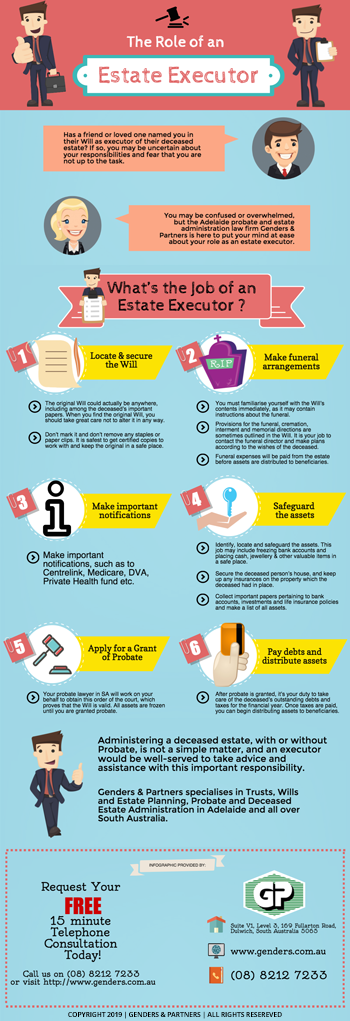

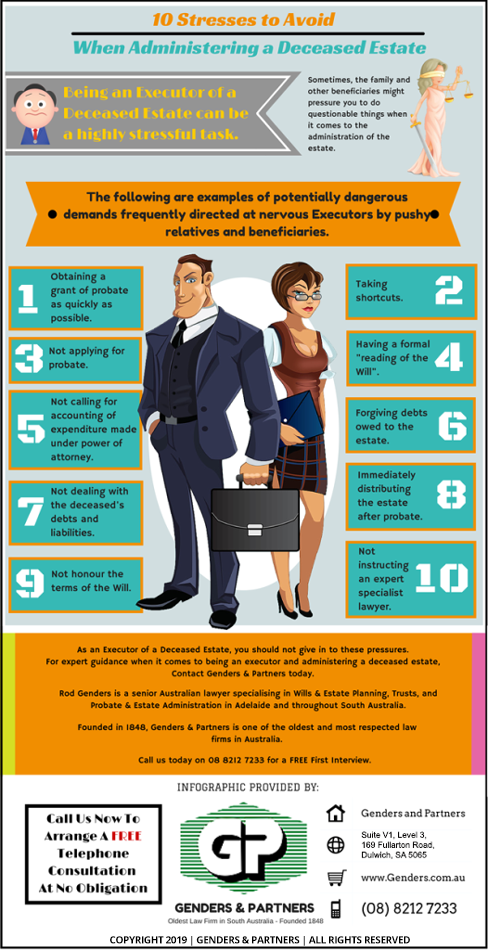

10 Stresses to Avoid When Administering a Deceased Estate

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road Dulwich, South Australia 5065

Administering a Deceased Estate Takes Care and Skill

In a 2014 Judgment, the Supreme Court of Queensland ruled that the administrator of a deceased estate breached her fiduciary duty by applying for her deceased son’s superannuation benefits to be paid to her personally, rather than on behalf of his estate.

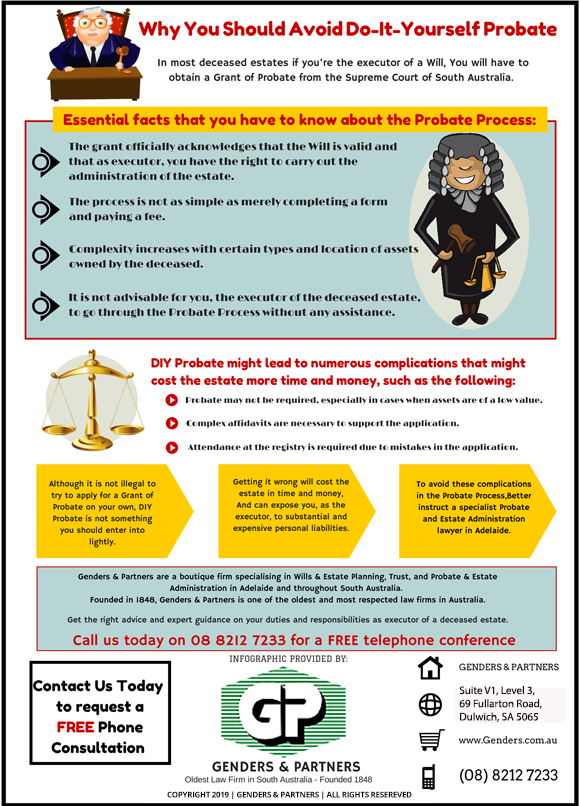

This is an example of where a little knowledge can be a dangerous thing. Probate and Deceased Estate administration is a specialised area of law. Don’t be fooled into believing the lady at the hairdresser or the bloke down the pub who says that it is easy to do this yourself, or that the lawyer who handled your divorce, or your uncle’s drink-driving offence, can easily do this. If you pay peanuts, you’re very likely to get monkeys.

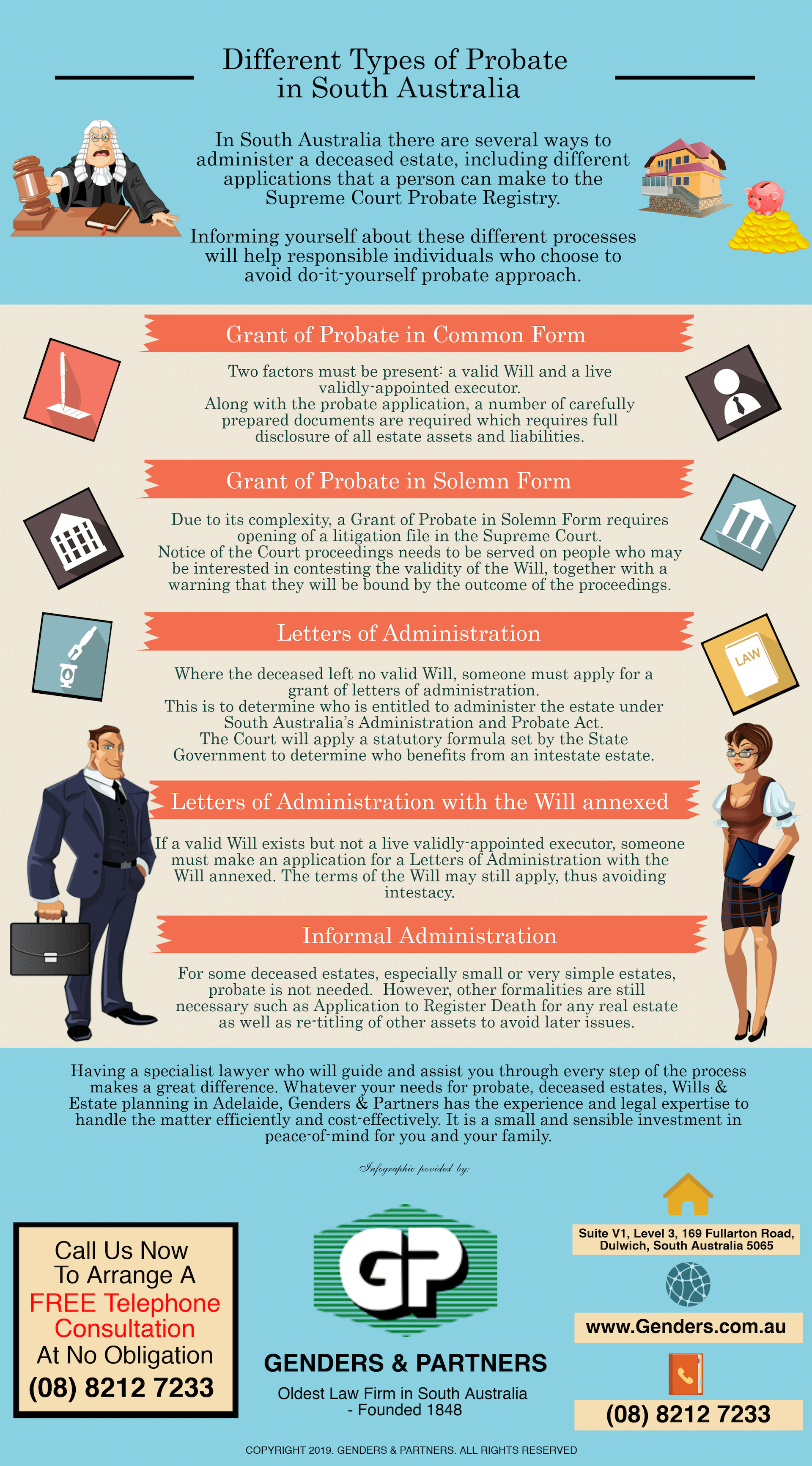

Why You Should Avoid Do-It-Yourself Probate

Contact Genders and Partners today on (08) 8212 7233 to arrange a FREE telephone consultation and to request a FREE copy of our special Report: “7 Things You Must Know About Wills and Estate Planning”. Genders and Partners is located at Suite V1, Level 3, 169 Fullarton Road, Dulwich, SA 5065

What Do Trustees of a Deceased Estate Do?

An executor of a deceased estate in Adelaide is responsible for administering the estate according to the terms of the Will and ensuring that all taxes and debts are paid. Trustees of a deceased estate, on the other hand, often have a longer and more complicated job that in some cases can last for years or even decades.

If you have been appointed as a trustee of a testamentary trust, you have certain legal requirements to uphold, and any failure to comply can leave you personally liable for financial losses suffered.

The best way to ensure that you understand your responsibilities and carry them out appropriately is to consult with a specialist Adelaide probate and estate administration law firm as soon as possible.

What is a Trust?

You can think of a trust as a type of container. Inside the container is something to be protected. This is called the trust fund. It is being held in safekeeping for the benefit of one or more people or entities, called beneficiaries.

A trustee is appointed to take control of the trust until a future date, at which time the trust fund is passed on to the beneficiaries. The trustee can be an individual or a private company appointed by the deceased.