As Baby Boomers start to keel-over, we are about to witness the greatest “transfer of wealth” ever in Australia’s history. This segment of society is a BIG chunk of our national population, and it represents a massive percentage of our private net-worth as a nation.

While this is happening, the Gen-X and Gen-Y youngsters are growing-up fast, and realising for the first time that bull-markets don’t last forever. They now have new burdens of responsibilities to their own kids coming through behind them. They are suddenly recognising that life doesn’t owe them, and they’ll have to work for what they want. It will be interesting to see how they cope. They’ve been raised in very good times, when the equity in our homes unlocked a never-ending orgy of consumerism. Who needed to save, when debt was so much easier, and capital gains would take care of that. Why delay gratification, when the latest big-screen home-theatre can be installed today, with payments over the next 10 years?

But now we are formally acknowledged to be in a debt-fuelled recession. Our economy has been very kind to us for a long time, and people have become used to a certain level of comfort and security – but that is no longer guaranteed.

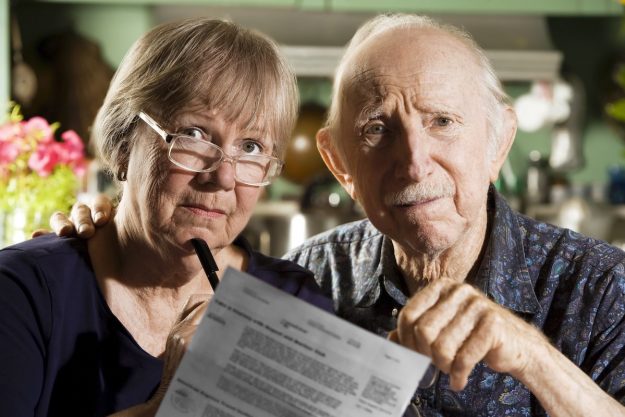

So how will you look after yourself and your family in these challenging times? Have you created a fully-integrated estate plan, and reviewed it regularly? Have you taken the steps necessary to preserve your wealth for your old-age, and to pass your assets onto the people you care about, or are you simply hoping to live forever?

Death & taxes, illness & share-market corrections may be unavoidable … but they don’t have to ruin your family or your business. Make the effort to protect the people you really care about. Call Genders & Partners for integrated estate planning in Adelaide and all over South Australia. And do it NOW … before it is too late.