Administering a Deceased Estate Takes Care and Skill

In a 2014 Judgment, the Supreme Court of Queensland ruled that the administrator of a deceased estate breached her fiduciary duty by applying for her deceased son’s superannuation benefits to be paid to her personally, rather than on behalf of his estate.

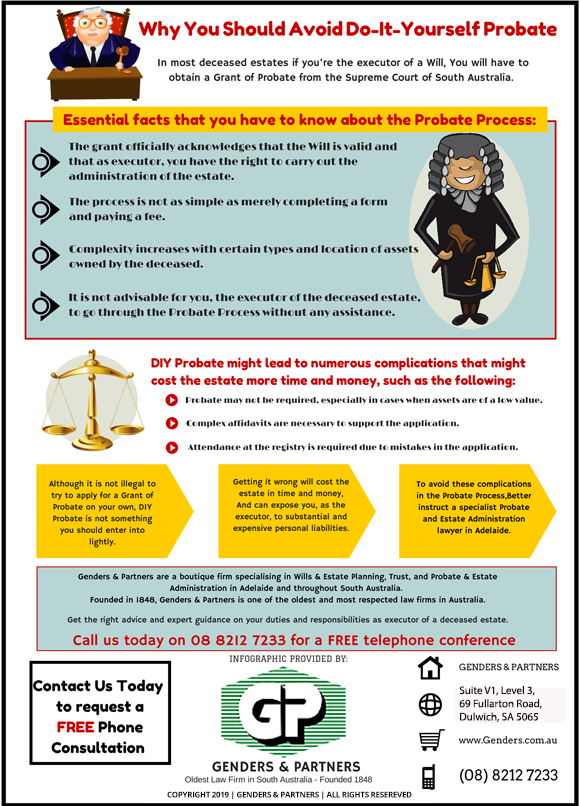

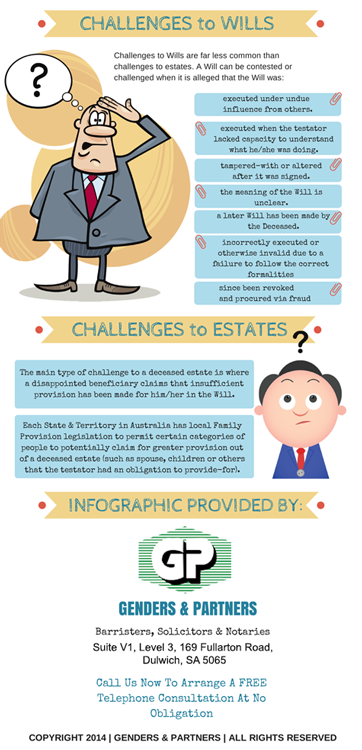

This is an example of where a little knowledge can be a dangerous thing. Probate and Deceased Estate administration is a specialised area of law. Don’t be fooled into believing the lady at the hairdresser or the bloke down the pub who says that it is easy to do this yourself, or that the lawyer who handled your divorce, or your uncle’s drink-driving offence, can easily do this. If you pay peanuts, you’re very likely to get monkeys.