Estate Planning Challenges: The Ageing of Australia’s Population

Thanks to modern health care, the ageing population of Australia is growing rapidly. According to the Australian Bureau of Statistics, the demographic of people aged 65 and older increased by 3.7 percent between 1993 and 2013.

These numbers are expected to increase more rapidly over the next decade. If you’re in fairly good health and able to care for yourself well into your golden years, this is great news.

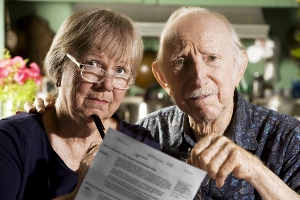

However, no one knows when an illness or injury could strike, requiring expensive long-term care and accommodations. Not planning for the future while you’re still of sound mind and in good health could be disastrous for you and your loved ones—physically, emotionally and financially. This is why it is in your best interest to meet with an Adelaide estate planning lawyer at Genders & Partners as soon as possible.

Legal Documents

When you meet with our experts on estate planning in Adelaide, we will assist you to protect yourself, your family and your assets. In addition to preparing your Will, we will provide advice and assistance on Powers of Attorney, and Advance Care Directives so that your loved ones know who is in charge of making certain decisions for you should you become ill or unable to make decisions for yourself. This leaves no one guessing or arguing over your wishes.