Intestacy: The Hidden Risks and Costs of Dying Without a Valid Will

Perhaps you intend to create a Will but just haven’t gotten around to it, or maybe the size of your estate is such that you don’t think you need one. “Dying intestate” is the legal term for dying without a Will or leaving a Will that does not adequately deal with all of your property.

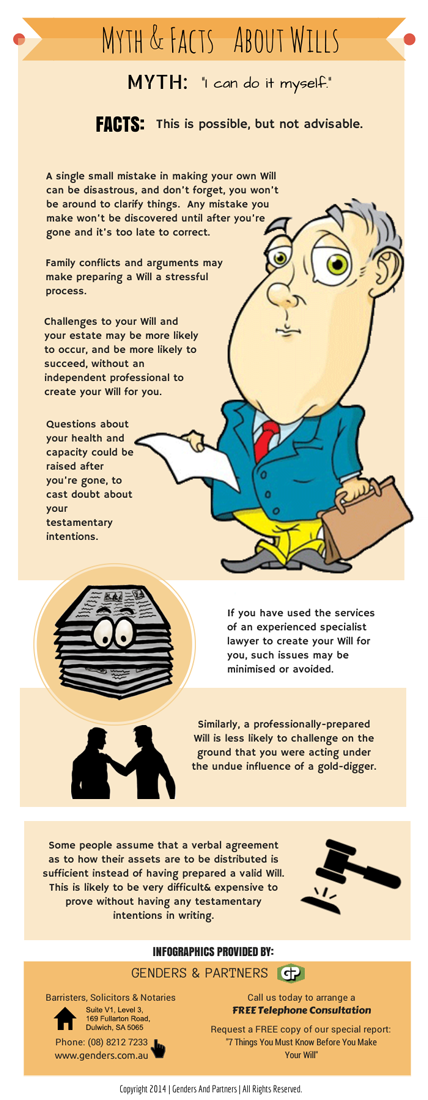

Intestacy is all but a guarantee that your loved ones will suffer a needlessly complex and expensive legal process after your death. Your best protection is to make your wishes known by consulting with a specialist Adelaide Wills lawyer at Genders & Partners.

Family Disputes and Costly Legal Battles

A Will dictates how your assets are distributed and names executors to lawfully carry out your wishes. Without a Will in place, you have no say in who inherits what. There are intestacy laws in every state and territory of Australia that determine the distribution of assets among your nearest blood relatives, but your loved ones may dispute the process and cause drawn-out legal battles, the costs of which are deducted from the estate. These state laws vary from time to time and from place to place, so the precise formula which decides who will inherit your assets depends on when and where you die.