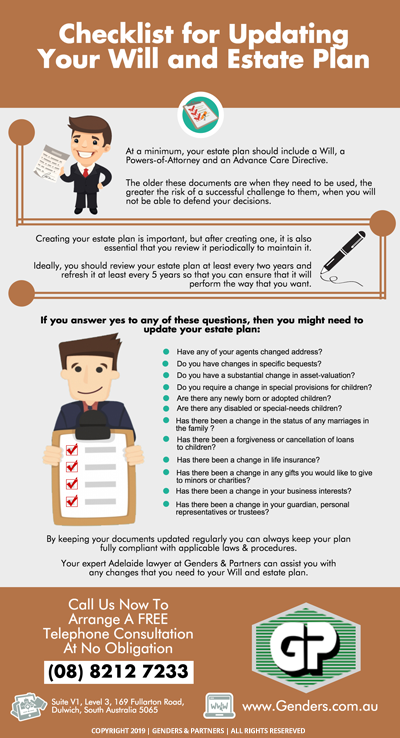

At a minimum, your estate plan should include a Will, a Powers-of-Attorney and an Advance Care Directive.

The older these documents are when they need to be used, the greater the risk of a successful challenge to them, when you will not be able to defend your decisions.

Creating your estate plan is important, but after creating one, it is also essential that you review it periodically to maintain it.

Ideally, you should review your estate plan at least every two years and refresh it at least every 5 years so that you can ensure that it will perform the way that you want.

If you answer yes to any of these questions, then you might need to update your estate plan:

- Have any of your agents changed address?

- Do you have changes in specific bequests?

- Do you have a substantial change in asset-valuation?

- Do you require a change in special provisions for children?

- Are there any newly born or adopted children?

- Are there any disabled or special-needs children?

- Has there been a change in the status of any marriages in the family ?

- Has there been a forgiveness or cancellation of loans to children?

- Has there been a change in life insurance?

- Has there been a change in any gifts you would like to give to minors or charities?

- Has there been a change in your business interests?

- Has there been a change in your guardian, personal representatives or trustees?

By keeping your documents updated regularly you can always keep your plan fully compliant with applicable laws & procedures.

Your expert Adelaide lawyer at Genders & Partners can assist you with any changes that you need to your Will and estate plan.

Request Your FREE 15 minute preliminary Telephone Consultation Today! Call us on (08) 8212 7233.

SPECIAL REPORT “7 Things You Must Know Before You Make Your Will”

In this report you will Learn:

Why home-made Wills can be a LOT more expensive than you might think.

The secret weapons used by the rich & powerful to protect their assets, and transfer their wealth two or three generations ahead.

How Estate and Trustee Companies make BIG money from “free” Wills.

The Most Common Estate Planning Mistakes, how they can cost your family a fortune, and How to Avoid Them.

The Elements of a Sound Estate Plan – why a Will alone is not enough.

How to Make Sure Your Assets Stay in Your Family and are not lost to creditors, lawsuits or ex-spouses.

How to guard against challenges to your Estate after you’re gone.